Online Property Tax Payments

You can choose to pay your taxes in installments, or in full. If you choose installments, the 1st installment is due November 10th and the 2nd is due May 10th. If you choose to pay in full, the entire amount is due by December 31st.

There are several ways to pay your property taxes.

You can come to the office in person at 806 9th Street.

You can pay your taxes through the mail. Our mailing address is: Platte County Treasurer, PO Box 1147, Wheatland, WY 82201. The bottom portion of your tax bill is detachable so that you can send that along with your check or money order. We honor the postmark for your tax payment.

We also have a convenient drop box located in the alley east of the Courthouse, between the Courthouse and the Sheriff's Office. You can drop your tax payment or your motor vehicle renewal.

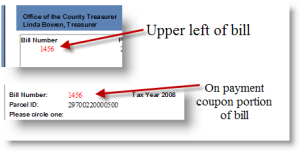

Taxes can be paid online. You will need to know your tax bill number and the amount due including any interest due. You can find the tax bill # on your tax bill, it is the red number in the upper left of the bill, or on the payment stub. Just fill in the information and your payment information will be sent to our office. (Note: There is an additional fee added during the credit card transaction as a fee to use the card - 2.55% with a $2.06 minimum, or if it is a VISA Debit, a flat fee of $4.00).

![]() If paying after the due date, please contact the Treasurer's Office for the total tax amount due including interest.

If paying after the due date, please contact the Treasurer's Office for the total tax amount due including interest.

Contact Information for the Platte County Treasurer's Office - Phone: (307) 322-2092 Fax:(307) 322-1340 Email: krietz@plattecountywyoming.com

Office Hours: 7:00 a.m. - 5:00 p.m. Monday - Friday