Treasurer FAQ's

If your vehicle still has a lien on it:

If your vehicle is still currently licensed in the other state bring:

- Current registration from the other state

- Proof of Insurance

If your vehicle is not currently licensed in the other state bring:

- The vehicle for a VIN inspection- if that isn't possible, you can get an out of state vin inspection form filled out in the other state.

- Proof of Insurance

- Previous out-of-state registration showing the vehicle has been licensed at least one time in your name.

If your vehicle does not have a lien bring:

- The title so that it can be transferred to a Wyoming title. (Copies or faxes are not accepted.)

- Proof of Insurance.

- The vehicle for a VIN inspection – if that isn’t possible, you can get an out of state vin inspection form filled out in the other state.

- Prior registration from out-of-state.

Wyoming does not allow for a refund of licensing fees; however, you can transfer any remaining credit to a newly purchased vehicle.

You can give your reserved number plate to another person if you choose to. Please fill out the reserved number plate transfer form and bring it to the Treasurer’s office. At the time of renewal, they can put that low number on their car.

Only family members may transfer fees from license plates. However, if you wish to give a particular plate number to someone else, you can do so. Just keep in mind, it will only be the plate number you are giving them. They will have to pay their own registration fees, even if the plate still has current stickers.

The plates on the car belong to the person who owned the car, not to the car itself. You are required to get your own plates and registration.

License and registration information is protected under the Driver's Privacy Protection Act of 1994. Only people with legal, legitimate reasons for requesting this type of information are entitled to it. If you do have a legitimate reason for obtaining registration information, please fill out the Information Request Form to request the information.

To replace the same number that you lost:

You can order a replacement set of your particular number for $30. It takes about 4-6 weeks to arrive. We can issue another number off the shelf to run on in the meantime, or you can park the vehicle until the replacement arrives.

To get a replacement numbered plate:

If you do not care what number you have, you can just come in and get a new set off of the shelf for $8.00.

We can reissue a new set for $6.00

Every county in the state uses the same calculations to issue registrations. No matter where you license your car, the registration fee should be the same.

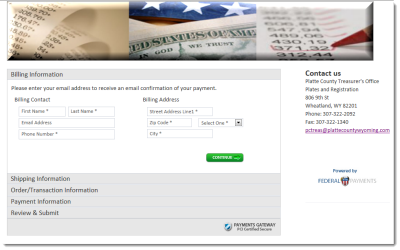

Yes, if you have a regular renewal and only need stickers you can pay for them online.

To pay for your registration renewal fees online, you will need to know:

- Plate Number

- Renewal Amount - add postage and handling

Once we receive confirmation of the payment, your new registration and stickers will be mailed out by the next business day.

I know my plate number and have included the postage and handling fee and I want to pay online.

We also have a convenient drop box located in the alley east of the Courthouse, between the Courthouse and the Sheriff's Office. You can drop your tax payment or your motor vehicle renewal in this box and it will be processed within 1 business day.

Prices for registrations are determined by Wyoming State Statutes. An explanation of the calculations can be found here.

Passenger plates can only be on passenger vehicles, and truck plates only on trucks. You can tell the difference in two ways.

- Look on your registration and if the letter after the "8" is a “P” then it is a passenger plate. If it is a “T” then it is a truck plate. (For example 8-T-7657 or 08-P-7657)

- Look on the physical plate. Truck plates say “8T” and then the number and also say "Truck" across the bottom.

Utility Passenger Vehicles (SUV’s or suburban’s etc) are plated as passenger vehicles.

State statutes require that sales tax be paid within 65 days from the date of purchase to avoid penalties and interest. Even if you have no intentions of registering your vehicle right away, the sales tax must be paid within this amount of time to avoid penalties and interest.

The state does not offer extensions. Other ways you can lessen the initial blow of taxes and licensing:

- Only pay the sales tax and title fees, and then wait to plate your car (you will be unable to drive the car once your temporary dealer permit expires).

- Transfer current plates from a car you sold or got rid of. There may be some credit available from those plates that will help lower the cost of your initial registration.

- Prior to purchasing the vehicle, talk to your lender about including the amount of your sales tax in the financing of the vehicle.

Sales Tax for Platte County is 6% of the purchase price of the vehicle. You can subtract rebates and trade-in value.

You pay the percentage of sales tax based on where you live, not where you purchased the vehicle, with the exception of Motorcycles, ATV's, MPV's, and boats. The dealerships will collect sales tax on those items. However, you will still have to show proof that the sales tax was collected at the dealer before you can get your title.

Pursuant to the Wyoming Department of Revenue, State Board of Equalization vs. Welch – a winner of a raffle is not liable for sales tax because they are a 3rd party to the sale.

If you have the title that is signed and notarized over to you:

Vehicles may be operated by the transferee for a forty-five (45) day period when accompanied by a properly executed title for the vehicle transferring interest in the vehicle to the transferee. In English, that means that as long as the title has been signed over to you properly and has been notarized, you can drive on the title alone for 45 days from the notary date.

If you do not have the title, and only have a notarized bill of sale:

Vehicles may be operated by the transferee for a sixty (60) day period when accompanied by a notarized bill of sale. In English, this means that if you have a bill of sale that is notarized, signing that vehicle over to you, then you can drive on that bill of sale alone for 60 days.

Note: Proof of insurance is required to operate a vehicle in Wyoming.

Wyoming Statute 39-13-103 (b)(i)(A) - All taxable property shall be annually listed, valued and assessed for taxation in the county in which located and in the name of the owner of the property on January 1.

The County Assessor examines the property, determines the value of the property, and keeps a record of the name and address of the property owner. The Assessor uses “fair market value” – the value a property should sell for on the open market. The fair market value is multiplied by the assessment level – 11.5% for industrial property and 9.5% for all other property – to arrive at the assessed value. The Assessed value is then multiplied by the mill levy (the total of all the different entities that you pay taxes to) to come up with the tax dollar amount due.

Example: A house in Wheatland has a fair market value of $100,000.00 and a mill levy of 75.89 mills.

- Fair Market Value = $100,000.00

Residential = 9.5%

$100,000.00 x 9.5% = $9,500.00 = Assessed Value

$9,500.00 x .07589 = $720.96 = Tax Bill

The County Assessor then transfers the values to the County Treasurer.

The County Treasurer is responsible for mailing the bills and collecting the property taxes. Property tax notices are mailed annually in September. The bill is sent to the owner of the property as of January 1st. The bill shows the amount due and when the tax is due.

If the deed for the property you purchased was recorded after January 1st, you will not receive a tax bill in your name. A taxpayer is responsible for payment of taxes regardless if they receive a bill. Rule of thumb: If you own property, you owe taxes. If you own property in Platte County and do not get a bill by the middle of October, call the Treasurer’s Office at 307-322-2092 and we will be glad to send you a copy.

If paid in installments:

The first half of the taxes becomes delinquent on November 11th. Taxes paid after that date are subject to 18% interest. The second half of the taxes becomes delinquent on May 11th of the subsequent year (there is no billing sent for the 2nd installment)

If paid in full:

If the entire tax is paid by December 31st, there will be no interest due on the first installment. We are closed to the public the last business day of December to close the books but we honor the postmark.

There are many ways you can pay your taxes other than coming in the office in person.

You can pay your taxes through the mail. Our mailing address is PO Box 1147, Wheatland, WY 82201. The bottom portion of your tax bill is detachable so that you can send that along with your check or money order. We honor the postmark for your tax payment.

We also have a convenient drop box located in the alley east of the Courthouse, between the Courthouse and the Sheriff's Office. You can drop your tax payment or your motor vehicle renewal.

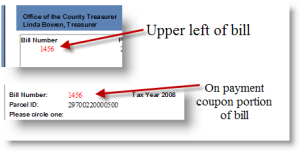

You will need to know your tax bill number. You can find that on your tax bill, it is the red number in the upper left of the bill or on the payment stub. Just fill in the information and your payment information will be sent to our office. (Note: There is an additional fee to use a credit card - usually about 3% or a flat fee of $3.95 if you use a Visa Debit Card).

Many taxpayers have an escrow account from which their taxes are paid. Our office sends an electronic file of all the taxes to the mortgage companies upon their request.

It is your mortgage companies responsibility to choose your tax(es) from the file and pay it. A tax bill is still sent as a courtesy to the customer for their records.

Mortgage companies must make tax payments in halves in November and May. Please feel free to call after the 15th of November and the 15th of May to see if your mortgage has made payment for your taxes. This is especially important for those taxpayers that have an irrigation bill that they think their mortgage company should be paying.

Unless you fill out a destroyed or permanently dismantled mobile home form available in the County Assessor's Office, you will continue to be billed for your mobile home. Once you have received your bill it is too late to take the bill off for that tax year but come right in and we will get the destroyed mobile home off the tax roll for the next year.

The County Assessor keeps all the updated tax addresses. Please call them at (307) 322-2858 or e-mail them at pcassessor@plattecountywyoming.com to change your address. This ensures that you receive all correspondence in a timely manner.

For any taxes that remain unpaid, a delinquent notice is mailed from this office around the 20th of May. The delinquent notice is sent to the same property owner as reflected on the original tax notice. The notice informs the taxpayer of the delinquency and if unpaid will be published three times in the Platte County Record Times and the lien subsequently sold at the tax sale.

Wyoming Statute 39-13-103 (b)(i)(A) – “All taxable property shall be annually listed, valued and assessed for taxation in the county in which located and in the name of the owner of the property on January 1.” Just as the bill is sent to the person who was the deeded owner of the property as of January 1st, the delinquent notice is sent to that same person, and the subsequent publication is in that name as well. If you receive the original tax billing in September, the only way to avoid having your name published is for the taxes to be paid. If you get the bill for property you sold, send the bill on to either the new owner or the closing company. If you get a delinquent notice, assume that unless action is taken in the near future your name will be in the paper.

Tax Lien Sales

I want to buy a house for taxes…can I move in tomorrow?

- You are buying a lien against the property, not the property itself. When a landowner doesn’t pay his/her taxes, the county sells a tax LIEN against property. The tax lien sale is usually held in July. The sale is lottery style. Each person gets one number when they sign in and if their number is drawn they have the opportunity to purchase the lien that has been assigned to that number. You could go home with all of the liens or none.

How much does it cost to buy the tax lien at the sale?

- The purchaser pays the amount of the taxes advertised in the paper plus a $20.00 Certificate of Purchase fee. The Treasurer’s Office accepts many forms of payment including cash, check, money order, or credit card. (Note: There is a fee to use a credit card…usually about 3%).

Why would I pay someone else’s taxes?

- There are actually 2 good reasons. You either get your initial investment plus 18% interest or you get the property itself (after the 4 year waiting period). The landowner has 4 years to pay off the tax lien, including all fees plus 3% penalty and 15% interest. The County then sends a check to the person that bought the tax lien. The check is for his /her investment plus the penalty and interest. If the landowner does not pay off the lien, the purchaser may apply for a tax deed on the land. The tax deed process is explained in detail in the Wyoming Statutes. If you have gone through the tax deed process and the landowner still has not paid off the lien, you can take possession of the property.

Contact Information for the Platte County Treasurer's Office - Phone: (307) 322-2092 Fax:(307) 322-1340 Email: krietz@plattecountywyoming.com

Office Hours: 7:00 a.m. - 5:00 p.m. Monday - Friday